What Are The Benefits Of A Company Car Loan?

apply for a loan how long does it take written by-Templeton Hawkins

A business Loan is a financing option for your small company. These financings are normally made to assist you get the cash you require to begin your company. Nevertheless, these loans will certainly require repayment, which means you will certainly need to pay rate of interest. There are numerous ways to decrease the price of your money. A small business loan will enable you to pay off the money immediately. Furthermore, it will save you money and time by not requiring to wait months for funds to show up.

Contrasted to bank card rates of interest, organization financings are more affordable to acquire than a charge card. The typical rate of interest for a business Loan is between 2% and 13%, while the average for an individual credit card is 13.9%. Another advantage of a small business loan is that you do not have to surrender control of your firm for the Car loan. With a bank loan, you can also obtain the funds you require without surrendering your equity.

A business Car loan may have numerous various kinds. The majority of them are installment finances that do not have a revolving credit line. Rather, customers have to repay the entire Loan amount in equivalent installments over a set term. Unlike a bank card, a service Car loan can be based upon cash flow. The lender will calculate the amount of cash you need based on the capital of your business. A small business loan might be the best alternative for you if you are intending to make use of the cash right away.

The payment terms of a service Car loan will vary relying on just how you use the cash. The most typical type of business Loan is an installment Loan. These financings require you to pay over an arranged period of time, as well as you repay the entire Loan amount in time. Unlike mouse click the up coming webpage , these car loans normally have a fixed interest rate, so it's important to check out the fine print as well as recognize the repayment terms before obtaining a small business loan.

Selecting the appropriate type of organization Car loan is very important for your company's future success. There are various types of fundings available to small businesses. The SBA offers a small business loan, and also a bank or different lending institution gives a line of credit. An SBA company Car loan can be an exceptional option for those who wish to obtain a big amount of cash in advance. A SBA Car loan can be a terrific option for companies that require a large in advance investment.

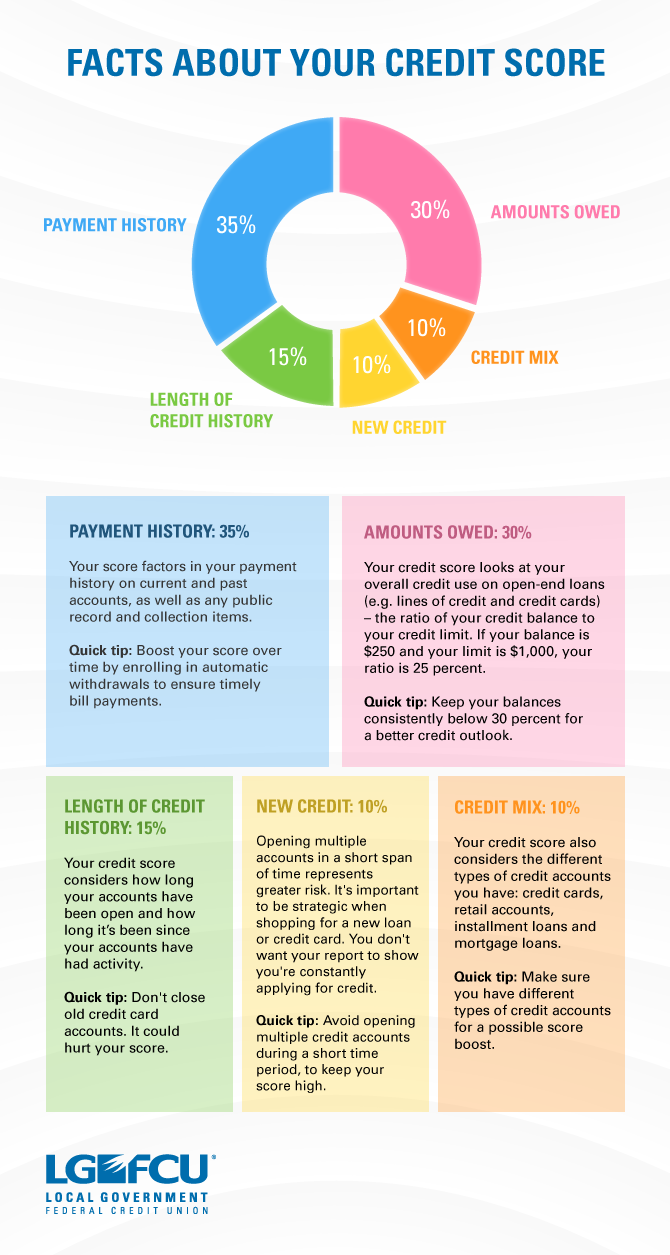

While looking for a small business loan, you need to carefully consider your credit report. Your credit report is just one of the elements lenders use to establish your dependability. It is essential to have a high credit rating as it will be harder to be declined if you do not have collateral. Some lending institutions are a lot more willing to supply fundings to individuals with negative credit scores, but you need to still inspect your credit score prior to making a decision. The much better your credit report is, the far better your possibilities are of obtaining the Loan you require.

Getting a business Loan is very easy if you recognize where to look. There are numerous loan providers around, and the criteria for acquiring a business Loan might vary significantly. By researching and comparing finances, you will have the ability to find the one that functions finest for you. There are several options for a bank loan, however you ought to select wisely. You need to contrast the interest rates and terms of each sort of financing before you get a lending.

Before applying for a small business loan, you should initially determine the sort of funding you require. There are various types of service car loans, and each has its own eligibility requirements. Generally, a bank loan will be an installation Car loan and will certainly need regular monthly payments. This type of Car loan is not revolving. http://riva0donnie.xtgem.com/__xt_blog/__xtblog_entry/__xtblog_entry/25332321-prior-to-you-can-look-for-a-loan-you-need-to-initially-make-a-decision-why-you-require-one?__xtblog_block_id=1#xt_blog is a single settlement. In addition to being unprotected, a small business loan can be safeguarded by any kind of property you have, such as a piece of machinery.

Besides typical financial institutions, there are additionally personal lending institutions. There are several ways to get a bank loan. You can look for small business loans in your area. If your regional lending institution does not provide this sort of funding, you might want to consider putting on a government-owned SBIC. These funds are independently had investment funds. They are an excellent method to gain access to resources for your small business. You can quickly make an application for a loan from a bank or other financial institution.